Exploring the Challenges and Opportunities Retailers Face as They Enter the Holiday Shopping Season

The 2023 eTail Holiday Shopping Report

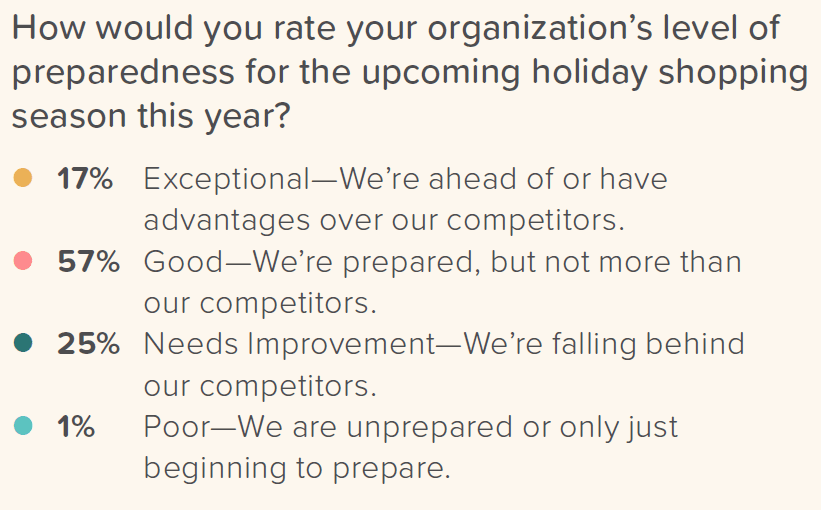

57% of retailers rate their organization’s level of preparedness for the upcoming holiday shopping season as good.

In the past few years, the holiday shopping season has become much more digital. Consumer demands for expedited services have only increased, putting pressure on retailers to stay on top of buying trends in real-time while also delivering personalization and fast fulfillment at scale.

Still, many consumers value a traditional holiday shopping experience. It’s now on brands and retailers to meet consumer needs while also maintaining the spirit of the holidays.

This report explores:

- Challenges and opportunities brands and retailers are facing

- Key benchmarking data

- Insights directly from retail leaders

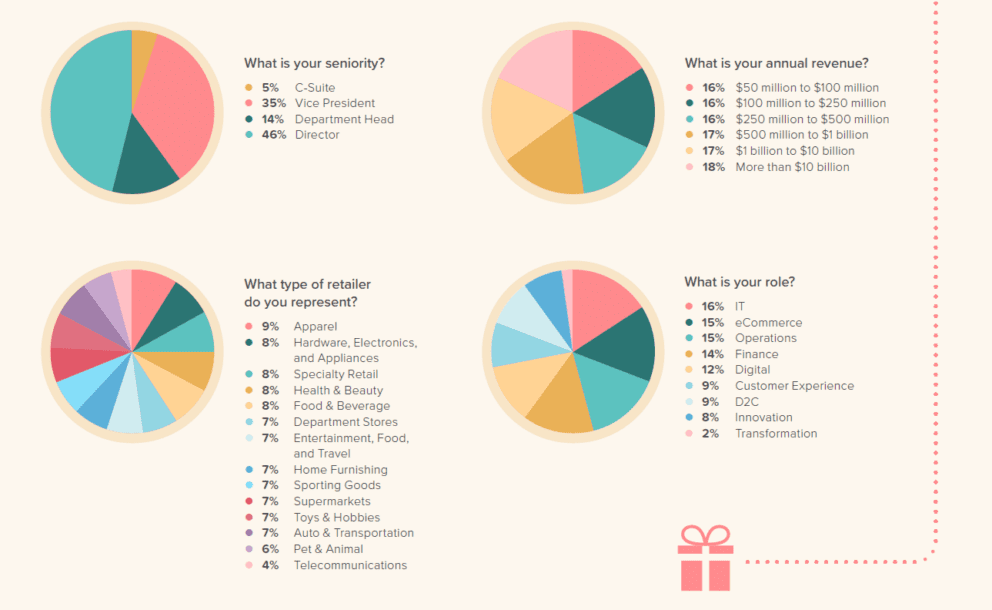

The WBR Insights research team surveyed 100 retail leaders from across the US and Canada.

Key Insights

AMONG THE RESPONDENTS:

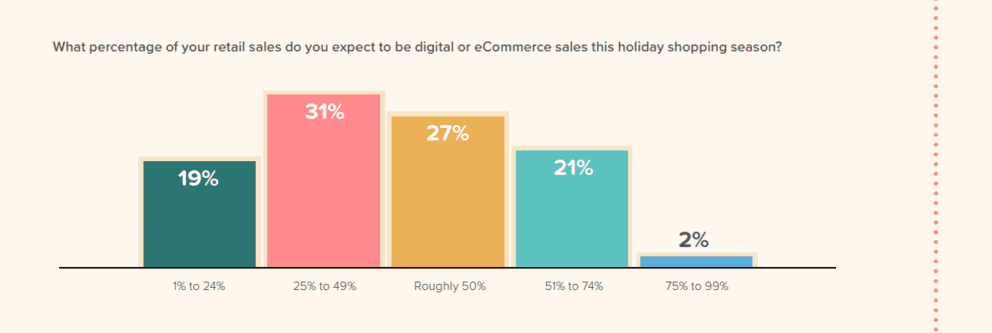

expect 50% or more of their sales to be digital or eCommerce sales during this year’s holiday shopping season.

are devoting 25% to 49% of their annual marketing budget to this year’s holiday shopping season.

have not made investments in their digital commerce technology platforms that might drive a more successful holiday shopping season.

Pressure Mounts from Inflation, New Competitors, and Demand Prediction

The retail industry has contended with unprecedented challenges over the past few holiday shopping seasons. With concerns around the COVID-19 pandemic beginning to subside, many brands are working to address other changes in the industry, including economic disruptions and shifts in consumer behavior.

Consumer eCommerce has become one of the most important channels for retailers during the holiday period. It is also one of the most competitive, as even small start-ups and DTC departments can compete online through excellent UX design and personalization.

At the time of the study, retailers were already making preparations for this year’s holiday shopping period.

At 57%, most of the respondents say their organizations’ level of preparedness for the upcoming holiday shopping season is “good.” They’re prepared, but no more so than their competitors. Only 17% consider their level of preparedness “exceptional,” meaning they are ahead of their competitors regarding their customer experience, digital shopping, merchandising, and marketing strategies.

Among those respondents who say their level of preparedness needs improvement or is poor, many say they are struggling with demand predictability.

According to a VP of customer experience at a home furnishing brand, “The biggest challenge is that customers chase only the holiday shopping season for discounts on purchases. Demand and inventory remain highly volatile during this season.”

Pressure Mounts from Inflation, New Competitors, and Demand Prediction

Similarly, a VP of operations from a hardware, electronics, and appliances brand says, “International and domestic economic inconsistencies are making it difficult to predict the holiday demand.” Other respondents in this category also cite “customer behavior,” “accurately managing inventory,” and “unpredictability in market demand” as significant challenges.

Although some of these aspects of the shopping season, namely economic factors, will be outside of the respondents’ control, they may be able to resolve some issues with demand forecasting using data analytics. They could also take steps to improve visibility and flexibility within the supply chain, so they can route products to key locations quickly during times of high demand.

For example, the respondents expect much of their holiday shopping business to come from eCommerce this year, so products could be routed to strategic warehouses and other locations where demand is high.

Specifically, 50% of the respondents expect roughly 50% or more of their retail sales to be digital or eCommerce sales during this year’s holiday shopping season. Supporting these sales will require significant investments in logistics and the supply chain, and regional data could shed some light on potential demand.

believe they have the tools and resources they need to support consumer demands this year.

say competing against new retailers, eCommerce sites, and non-traditional sellers is one of the most significant challenges their organizations face.

use AI in their UX optimization strategies, while 51% are prioritizing it.

There was also a notable decrease in eCommerce sales expectations this year compared to last year. In 2022, 56% of the respondents believed that roughly 50% or more of their sales during the holiday shopping season would be eCommerce sales. This change is likely due, at least in part, to the re-opening or retail stores and diminishing concerns about the pandemic among consumers.

Nonetheless, many retail companies are focused on preparing their digital stores and eCommerce platforms for a significant influx of customers.

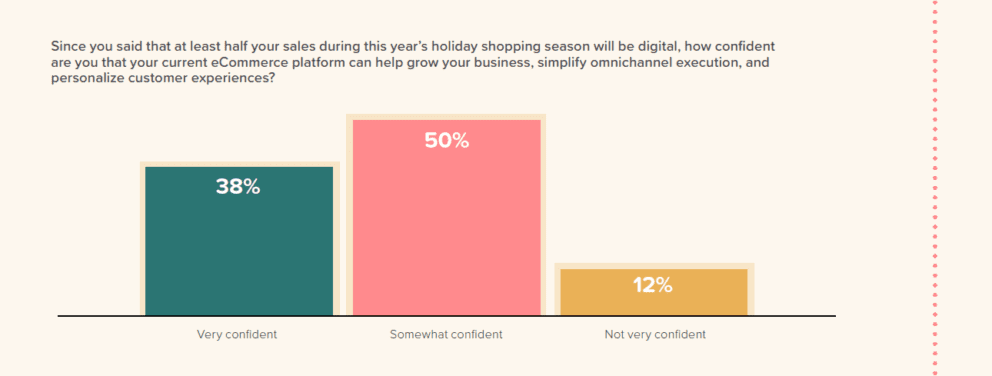

Among the respondents who expect 50% or more of their sales to be digital this year, more than one-third (38%) are very confident about their current eCommerce platforms. However, 50% say they are only somewhat confident that their current eCommerce platforms can help them grow their businesses, while 12% are not very confident.

Most eCommerce platforms will be stressed by increased demand during the season, and peaks in demand can be difficult to predict. While most businesses can expect high rates of visitors on days like Cyber Monday, they must be able to reallocate computing resources quickly throughout the holiday months.

Furthermore, eCommerce competition is fierce, and consumers aren’t as loyal to individual retailers as they once were. Sellers that can provide consumers with an optimal digital shopping experience, as well as great discounts or promotional offers, will be in a better position to capture sales.

Most retailers recognize the importance of the holiday shopping season, so they are allocating a significant amount of money and resources to the period. These include staffing resources, but also computing resources and funds for marketing initiatives.

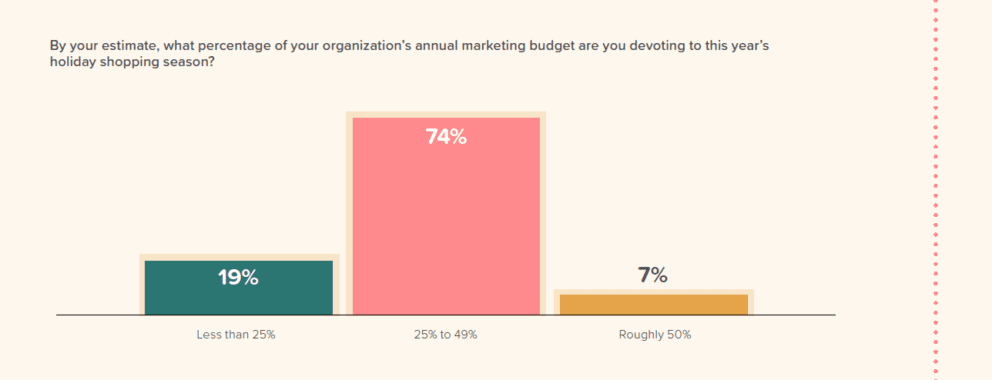

According to the study, most of the respondents (74%) will allocate 25% to 49% of their annual marketing budgets to the holiday shopping season. Another 7% will devote roughly 50% of their marketing budgets to the season.

This is a significant decrease in marketing budget allocation compared to last year. In 2022, 62% of the respondents devoted roughly 50% of their marketing budgets to the holiday shopping season, while 20% devoted 51% to 75%.

Last year, many retailers were attempting to make up for drops in sales caused by economic factors like inflation, as well as the COVID-19 pandemic. This year, retailers demonstrate that the holiday shopping season is still important, but they aren’t investing as much in terms of marketing.

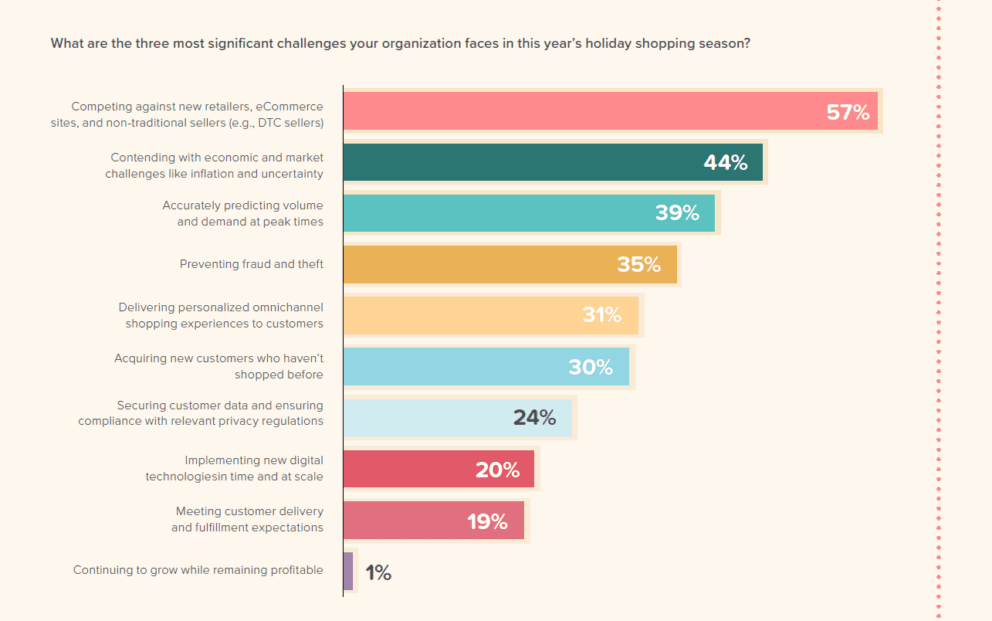

Furthermore, retailers are facing some significant challenges this year that may require more of their resources to be diverted from marketing. For example, 57% of the respondents say competing against new retailers, eCommerce sites, and non-traditional sellers like DTC sellers is one of the most significant challenges they face. In many cases, competing against these players will require investments in the online user experience, data analytics, and personalization, which don’t strictly fall under marketing parameters.

The two other top challenges retailers identify are economic challenges like inflation and uncertainty (44%) and accurately predicting volume and demand at peak times during the season (39%). The latter challenge aligns with what many respondents mention in their verbal responses relating to demand predictions.

Retailers Are Confident in Their Technologies but Lack AI Capabilities

Data technologies are now critical for retailers during the holiday shopping season for several reasons. Most importantly, retailers must be able to personalize online shopping experiences as much as possible, providing shoppers with plenty of incentives to make purchases.

However, data technologies are also crucial to internal operations. Retailers can use data analytics tools to forecast demand for specific products, which allows them to shift resources to important locations during times of peak demand. Similarly, eCommerce technologies that monitor online traffic can enable companies to reallocate computing resources during hightraffic periods so their eCommerce sites stay operational.

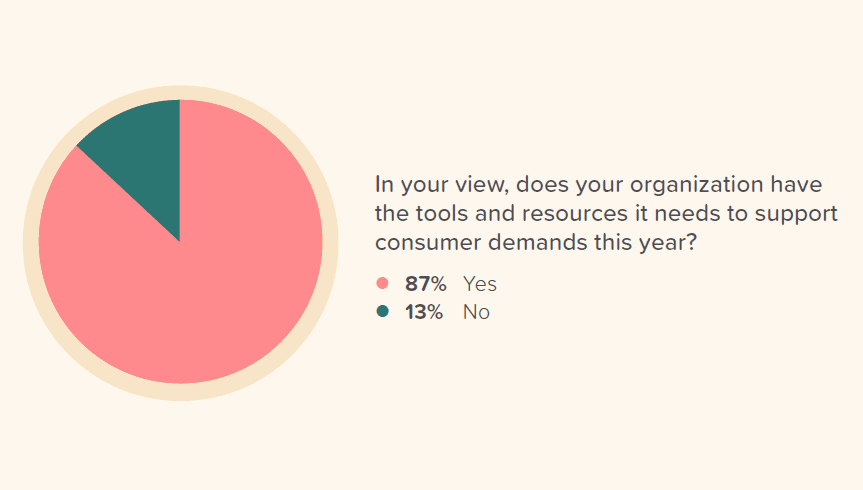

Most of the respondents (87%) agree that they have the tools and resources they need to support customer demands this year. Although many respondents have voiced concern about predicting demand during the holiday shopping season, almost all of them feel that they have the technologies in place to respond.

Most retailers will leverage a combination of technologies to support demand. These include inventory management systems, which allow them to keep track of stock levels in real-time and automate re-ordering, as well as standard CRM software. This year, some retailers may even be using artificial intelligence in some capacities, whether it’s to handle customer inquiries or analyze data from multiple sources to identify trends.

For example, some AI solutions now enable retailers to collect and analyze behavioral data from website visitors to generate insights. Although this practice is immensely useful for retailers, some consumers are concerned about corporate data collection practices, especially those that depend on personally identifiable information (PII).

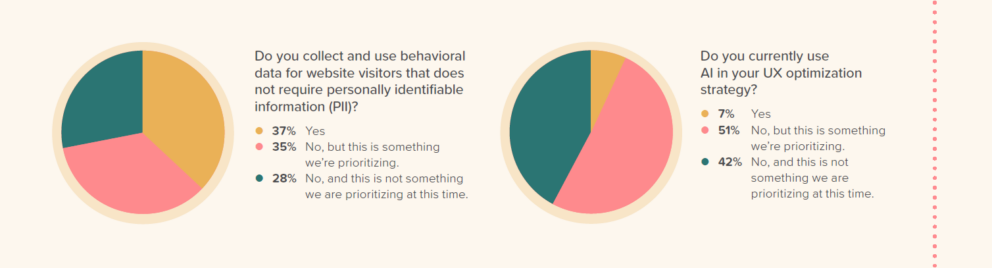

Currently, more than one-third of the respondents can collect and use behavioral data that does not require PII. More than one-third still depend on PII, but they say they are prioritizing collecting behavioral data that doesn’t depend on it.

Achieving this capability will be an important step toward winning customer trust in the future. Despite the usefulness of PII, most digital shoppers would likely prefer retailers to gain insights without them having to submit sensitive information.

As mentioned, some retailers are using AI as part of their strategies this year. However, only 7% say they are using AI in their UX optimization strategies. Most of the respondents (51%) say they aren’t currently using AI for UX optimization, but it is something they are prioritizing.

AI and automation will be essential tools in personalizing the eCommerce experiences of the future. With the right solutions, retailers can personalize the shopping experience for each customer in real time based on their browsing and purchase history, as well as other data points. This can lead to increased engagement, loyalty, and revenue.

Companies that effectively leverage AI technology can gain a competitive advantage by delivering a more seamless shopping experience than their competitors. And by automating tasks using AI, retailers could save considerably on costs.

Most Companies Made Investments in Their Digital Commerce Technology Platforms

Digital commerce technology platforms are already essential for retailers’ basic operations, and they are more critical during peak shopping periods like the holiday shopping season. These platforms enable retailers to establish an online storefront, manage their inventory, process transactions, and fulfill orders in a timely way at a time when every minute counts.

Although digital commerce platforms are now commonplace, some offer more capabilities than others.

Most platforms also offer a variety of marketing and analytics tools that enable retailers to optimize their digital sales channels and reach more customers during the holidays. Ideally, they’ll even provide a seamless and secure shopping experience for customers, including features such as mobile responsiveness, multiple payment options, and fraud protection.

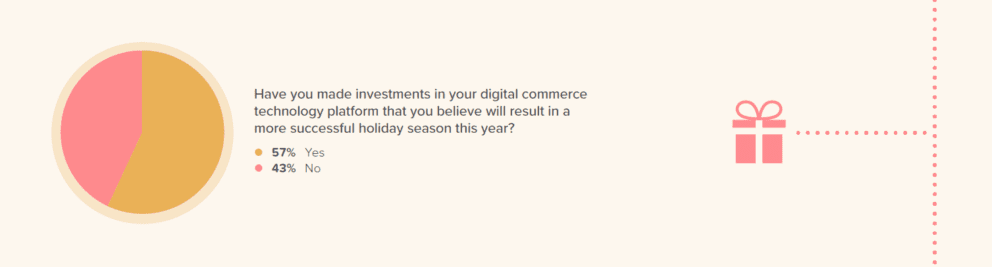

Most of the respondents (57%) say they have made investments in their digital commerce technology platforms this year. They also believe these investments will result in a more successful holiday shopping season.

Despite these investments, a significant number of respondents (43%) say they have not made investments in their digital commerce technology platform this year.

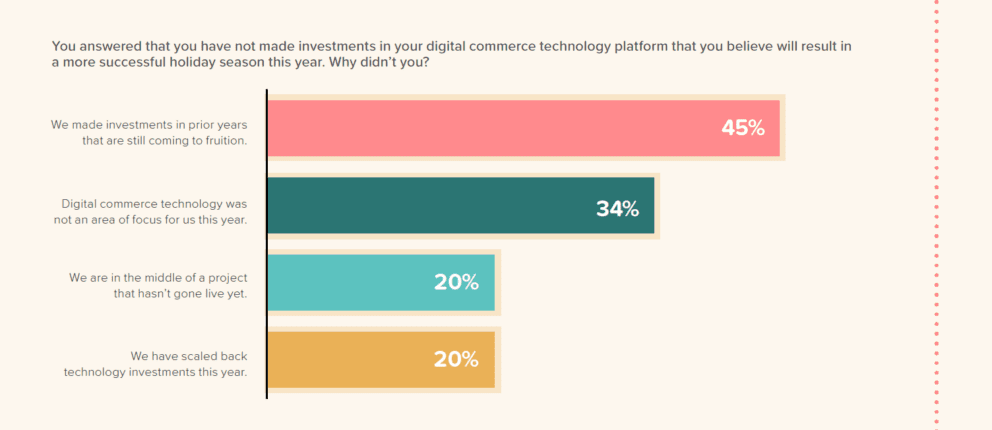

As noted, many of these respondents (45%) say they made investments in prior years that are still coming to fruition. They may still be gathering data on pilot eCommerce programs or are working to implement novel programs in time for the holidays.

More than one-third of these respondents (34%) say that digital commerce technology was simply not a focus for them this year. Others are in the middle of a project (20%), while others still have chosen to scale back technology investments this year in favor of other priorities.

Conclusion: Competitive Factors for This Year’s Holiday Shopping Season

The results of the study suggest that most retailers are relatively well-prepared for this year’s holiday shopping season, but they have identified important gaps in their technology as well as some notable challenges that will drive competition.

As many of the respondents have said, demand prediction is of particular concern, as not every retailer has the tools they need to act in real-time during periods of peak demand. This could put a strain on their supply chains as well as their digital commerce sites.

Despite this, most of the retailers say they have the tools and resources they need to support consumer demand this year. Only time will tell whether issues with demand prediction become a significant challenge during the season or whether retailers indeed have the solutions necessary to match consumer buying behaviors.

Only a handful of the respondents say they can currently use AI to make UX design decisions. This implies that this use case for AI technology is still relatively new to the industry. Investing in AI-based UX capabilities could soon become a differentiating factor in the marketplace.

Finally, most of the respondents indicate that investments in their digital commerce technology platforms are a priority this year. They are focusing on digital commerce-adjacent technologies like MarTech as well as more modern types of digital architecture.

Even those respondents who say they didn’t make investments into their digital commerce technology platforms suggest that, although investments weren’t forthcoming this year, they’ve made investments in the past. That said, further investments will be required moving forward, as digital commerce technology will likely become one of the most competitive factors in the eCommerce space.

This eTail report is sponsored by Monetate.

Get Your Tech Ready for the Holidays

Make your business more personal. Make it more profitable.