2024 Back to School Shopping Trends

By some accounts, consumers began their back-to-school shopping before classes had even come to an end in June. But according to research from multiple sources, August will be the top month for 2024 back-to-school shopping. In a survey of nearly 1500 consumers by Zeta, 41% of respondents said they planned to do most of their shopping in August.

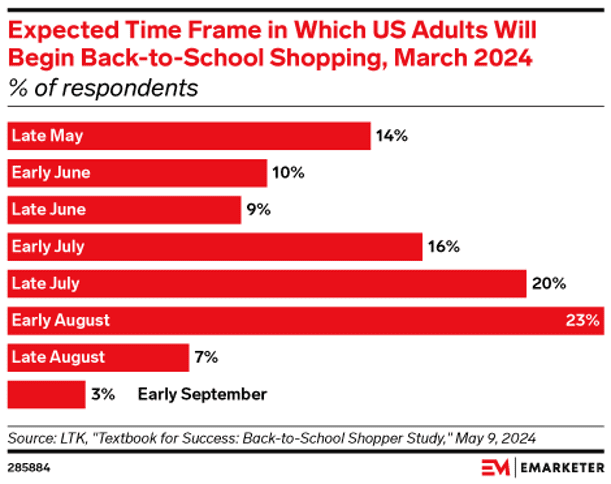

Expected Time Frame for 2024 Back-to-School Shopping in US: eMarketer

Data from eMarketer supports early August as the choice shopping month, so now’s the time to understand important trends that can help inform your back-to-school shopping approach as we move closer to the school year and beyond.

How Much Back to School Shopping is Done Online?

Digital channels are an important touchpoint for back-to-school shoppers, though eCommerce and mCommerce (mobile commerce) don’t stand alone (no channel does). We’ll get to that a minute – first some stats. According to data from Capital One, 55% of K-12 back-to-school shoppers plan to make purchases online in 2024 versus 45% who will shop in department stores.

Amazon Prime Day, which came and went in mid-July, already claimed a large cohort of back-to-school bargain hunters, with Capital One reporting that 66% of shoppers planned to purchase college or school supplies from the eCommerce megalith.

But Amazon and other online marketplaces aren’t the only outlet for consumers. Many back-to-school shoppers are adopting an omnichannel approach this year. Per Capital One data, 41% of consumers plan to evenly split back-to-school spending between online and offline channels. Online shopping includes retailers’ websites, but goes far beyond that, extending to marketplaces, social media (which is both a shopping destination and an advertising channel), and mobile apps. Young parents, in particular, use social media to find good deals and compare prices.

As we unpack the back-to-school shopping trends for 2024, it’s clear that retailers need to consider all the different ways consumers research and purchase school supplies to capture the full potential of the back-to-school market.

2024 Back to School Shopping Trends

We’ve collected a list of 7 important back-to-school shopping trends from sources that include the NRF, eMarketer, Capital One, Zeta, and our own research on 2024 omnichannel commerce trends. Use this info to inform your back-to-school marketing strategy from – and don’t forget to file these insights away for the 2024 holiday shopping season as well.

1. Smartphones Are an Essential Shopping Tool

Mobile devices have become an essential tool in the back-to-school shopping process, particularly for millennial parents. Kids, who obviously influence what parents buy in a big way, use mobile apps like TikTok to discover items and purchase products directly. Shoppers of all ages use their smartphones to make purchases, research products, compare prices, and hunt for deals.

2. Even Late-to-the-Game Shoppers Want Early Birds Deals

Back-to-school shopping is starting earlier each year, with many consumers beginning their hunt for supplies and deals as early as June. But this doesn’t mean they’re buying early. Rather, school supply shopping happens throughout the summer with the shopping season driven by budget-conscious parents looking to spread out expenses and take advantage of various promotions. Retailers are responding by offering “Black Friday in July” type events and staggered deals throughout the summer.

3. Omnichannel is the Only Channel

As we touched on above, 2024 back-to-school shoppers are taking an omnichannel approach. Whether it’s mobile, social, physical stores, or your website, shoppers move between online and offline destinations with the singular determination of detectives looking for the best possible deals. They’ll research products on their phones, pop into Instagram to find inspiration, check in-store availability online, and then visit physical stores to make purchases. No retail stone goes unturned.

4. Deals Are Worth Waiting For

Back-to-school shoppers are largely price-conscious shoppers. The Zeta research found that parents are cutting costs by shopping for store brands and generic products and sticking with basics when it comes to buying supplies. Per data from Google, 71% of U.S. shoppers are fine waiting two weeks or more if it means they’ll save money via a deal or sale. NRF data supports this – it shows that “waiting for the best deals” is a top reason that 45% of shoppers wait to make a purchase.

5. Electronics are a Back-To-School Essential

According Capital One data, nearly 70% of back-to-school shoppers will allocate some of their budget to electronics. School supplies, once relegated to notebooks, pencils, and calculators, now include laptops, tablets, e-readers, and smartphones. These are the most expensive purchases, averaging about $337 per household. The Zeta survey found that many shoppers, whether parents buying for their K-12 students or college students shopping for themselves, don’t plan to buy larger ticket items like electronics until September.

6. Gen Alpha Brings a Tech-First Mindset to School Supplies

The oldest members of Generation Alpha—born from 2010 onwards—are now entering high school. As the first truly digital-native generation, Gen Alpha is weighing in on the school supplies their parents buy. Over 80% have a say in school supply purchase decisions. Unsurprisingly, they’re more focused on tech tools to help with learning versus traditional staples like Trapper Keepers and detachable erasers.

7. Budgets are Expanding, But with a Focus on Value

Despite economic concerns, back-to-school spending is on the rise in 2024. The NRF projects total back-to-school spending will reach about $41.5 billion, up from $36.9 billion last year. Families are budgeting more per child, with an average spend of $890.07 for K-12 students. Despite the higher overall budgets, shoppers are focused on getting value for their money. They’re hunting for bargains and waiting for the best deals. Many people are spreading their purchases across the summer to better manage costs and take advantage of sales as they crop up.

8. Flexible Fulfillment is A Back-to-School Essential

Different fulfilment methods are important in an omnichannel shopping environment since the shopping journey isn’t a linear one. Mom might start school shopping when Junior forwards a link from TikTok, do a bit of online research, then order the items to be delivered to her local Target (for example). Per data from eMarketer, nearly three-quarters of consumers plan to buy their back-to-school loot in a physical store, but they may start the purchase process online and complete it in the Target parking lot or at the pick-up counter. Buy online, pick up in store (BOPIS) usage has jumped to 43% (up from 34% in 2023), and curbside pickup is now used by 25% of shoppers (up from 19%).

9. Parents are Using School Shopping as an Excuse to Treat Themselves

Turns out that back-to-school season isn’t just about the kids. A Deloitte survey revealed that 50% of parents plan to purchase something for themselves. Parents who indulge in a little treat for themselves during the school shopping frenzy tend to spend 1.4 times more than those who don’t. Tapping into this high-intent-to-buy by enticing parents with customized offers, personalized product recommendations, and relevant messaging that encourages a bit of splurging during the stressful end-of-summer weeks when to-do lists seem endless.

Tips for Retailers to Capitalize on Back to School Shopping

It’s one thing to understand trends, it’s quite another to act on them with effective strategies that connect shoppers to products. Here are some tips focused on mapping the 2024 back-to-school trends with actionable strategies:

Optimize for mobile

- Smartphones play a big role in back-to-school, particularly when you factor in Gen Alpha’s comfort with tech and the fact that they’re starting to enter high school. Your website should be mobile-friendly – fast loading, easy to navigate, and supremely intuitive (incorporate elements like personalized search and mobile payment options.)

Lean into relevance

- Since shoppers use multiple touchpoints and devices across a hybrid physical/digital (e.g., phygital) journey, personalization is incredibly important. You can use AI features like product recommendations and personalized search to connect shoppers to relevant items. AI-powered personalization uses data to make this possible (e.g., browsing history, previous purchases, demographic information, etc.).

Analyze and act on search data

- The keywords shoppers use contain a wealth of insight about their intent. Use this data to inform your product offerings, recognize new trends, and understand what people are interested in when they visit your website. Analyzing back-to-school-specific searches can help you customize offers and messaging, so that it resonates with shoppers and, most importantly, helps them find what they need.

Think beyond your website

- As we noted above, social media is increasingly influencing younger shoppers, becoming platforms for product discovery and virtual storefronts. Craft content specifically for social platforms that young people use (ahem: TikTok) with a focus on showcasing your products using video, compelling images, and influencers.

Implement strategic pricing

- Back-to-shoppers care about bargains. Strategic pricing strategies that include competitive deals and tactics like Flash sales throughout the summer and into September can bring them back to your website repeatedly throughout the back-to-school shopping season. You can also bundle products and create offers that combine products in a compelling way (e.g., pair traditional supplies with tech products or price breaks on jeans for the whole family).

Go big with omnichannel

- Consumers don’t distinguish between channels and nor should you. Connect the dots between online and offline touchpoints by offering multiple ways for your customers to buy and fulfil orders. Services like BOPIS, curbside pickup, and home delivery create a consistent buying experience. Likewise, make sure messaging (and offers) are consistent across channels – that coupon in your customer’s app should be redeemable if they decide to drop into the store.

Extend the school shopping season into September

- With consumers spreading out back-to-school purchases, retailers have an opportunity to stretch their marketing efforts late into summer and even early fall. For example, run a series of limited time “flash” sales on back-to-school products to inspire visitors and get them to convert faster, plus entice them to return during the season as they hunt for more surprise sales.

Don’t set it and forget it

- The key to success lies in understanding your specific audience and continually optimizing these strategies with testing and experimentation. Monetate’s experimentation tools, including A/B/n testing, dynamic testing, and feature experimentation, allow retailers to fine-tune their approaches based on real-time data and consumer responses.

Add a Personalization Platform to Your Curriculum this Year

As back-to-school shopping evolves, retailers need tools that adapt to what tech-savvy, bargain-motivated shoppers want. A personalization platform like Monetate makes it possible to tailor shopping experiences to individual customers in a few different ways.

First, it ties shopping touchpoints and channels together into one omnichannel experience. Monetate allows you to leverage data from multiple touchpoints and create targeted campaigns for specific audiences. For example, target messaging and products to parents who are also shopping for themselves (e.g., “Getting some fall gear for your kids? Treat yourself too! Women’s hoodies are on sale through September 14th.”)

Personalization can help retailers provide consistent messaging across online and in-store channels, catering to the 74% of shoppers who plan to make in-store purchases while also appealing to the growing number using BOPIS and curbside pickup options.

You can also personalize messaging for your bargain-hunting customers, for example, by delivering tailored discounts and bundling products based on individual browsing and purchase history. As Gen Alpha gains influence in back-to-school decisions, personalization can help retailers identify their tech preferences and social media behavior, then create campaigns that resonate with this digital-native generation (and their parents).

Bottom line: a personalization platform empowers you to turn your wealth of consumer data into actionable insights, leaving no trend unturned (and keeping customers happy).